Stripe Alternatives & Other Payment Methods: A Brief Overview

Stripe, PayPal, Adyen, Paddle, Lemon Squeezy: There are many alternative payment solutions to Google and Apple Pay. Check their pricing and functionality here.

Stripe, PayPal, Adyen, Paddle, Lemon Squeezy: There are many alternative payment solutions to Google and Apple Pay. Check their pricing and functionality here.

When was the last time you purchased something on Google Play? How about paying for a trinket or additional functionality in the app itself? Think Etsy Plus, a premium subscription providing sellers with an ad-free experience for their shops, custom web addresses and monthly credits for Etsy Ads. Or advanced lessons and personalized practice offered by Duolingo to those who pay up to get premium educational materials.

So, paying for an app when purchasing via Google Play or Apple’s App Store, or getting that premium subscription or unlocking some additional features is nothing out of the ordinary for most of us. But is the process satisfying enough? What’s the experience like in more advanced cases? What if you need an invoice for purchasing an app as a business?

What should you do if you need your taxes to be handled properly at the same time as you pay for the app or a digital service?

With the EU’s Digital Markets Act coming into force, alternative payment providers come to the fore to solve many of the problems users had to deal with when using Google and Apple payment processing. Payment processors like Stripe and PayPal, or more niche products and systems alternative to Stripe, say Lemon Squeezy or Paddle, offer wider functionality and, more often than not, better value for money.

In this article, we’re going to explore what payment processing systems can you use, how these solutions are regulated by law, and whether there’s a risk of getting kicked out of Google’s or Apple’s app store. We will also take a look at whether there’s any danger in using the most popular alternative payment methods and the business related factors you should consider when choosing the right option out of all the providers on the market.

Not sure if you can use the Google or Apple payment system alongside the alternative payment method? Want to know what models you can use depending on the region your app operates in and what local payment methods there are? Looking for a short but feature-rich guide on online payment processing options out there to get maximum customer satisfaction?

Read on to learn all of this and much more!

Before the adoption of the Digital Markets Act (DMA), both Google and Apple were quite strict about the payment options they offered. In most cases, the two tech giants mandated their payment methods as the primary ones, if not the only ones. Accepting alternative payment methods was out of the question. Implementing lots of popular alternative payment methods that ensure the ease of processing payments and online transactions, or changing the payment strategy was very challenging.

Only when we wanted to sell some goods or offer physical services was it possible to use alternative payment providers. There were a slew of other exceptions, too, as was the case in the Asian market. And yet, in-app payments had to be made via Apple Pay and Google Pay. Paying with a credit card or using a QR code to go off-platform was unavailable.

The universal and standard fee charged by the Google Play Store is 15% per year. However, when app developers exceed the cap of $1M (USD) in revenue earnings annually, they should expect to pay a 30% fee. Apple charges a whopping 30% fee for apps and in-app purchases too.

It should come as no surprise that, with credit card processing fees and transaction fees this high, the EU decided to take action. The absence of a monthly fee is a benefit of some alternative payment providers. The alternative payment providers also took action, starting to offer more palatable fees. Now that DMA is liberalizing the digital space, app developers can benefit from a smorgasbord of various payment providers or combinations of them catering to any of their needs, from Stripe to Adyen or Lemon Squeezy.

As a business, getting a proper invoice from Apple or Google is no mean feat. Getting an invoice after purchasing an app as a B2B buyer requires a developer’s account, which costs $25. You can always ask tech support to provide you with an invoice ‘manually.’ However, this isn’t a workable long-term solution, and tech support only sometimes offers such an option.

Alternative payment providers solve this issue. Take, for example, Stripe. Stripe gives you an itemized list of goods and services rendered, including the cost, quantity, and any applicable taxes. It can also collect payment through a range of other supported payment methods apart from Stripe’s in-built payment method. It allows you to manage your invoices through the API or dashboard and customize how they look through your invoice template settings.

After switching to an alternative payment solution provider, the chances of getting a proper invoice and 24/7 customer support grow higher. Doesn’t their approach start to seem worlds apart from that of Google and Apple?

Apart from the above, it is also worth mentioning that there was lack of support for accounting software, local card schemes, many ecommerce platforms, multiple sales channels, mobile wallets . To say nothing of the absence if fraud protection

The DMA’s Article 5 introduces significant changes from a payment processor sector perspective. It states that the gatekeeper’s platforms may no longer require app developers to stick to their own payment processors or systems. They will now have to accept payments made using a third-party payment processor. This promises the long-awaited unbundling of payment services from gatekeepers’ core platform services. Which will result in improved competition and better choice for online businesses in terms of their payment options.

This shift will allow businesses and app developers more flexibility and freedom in choosing their payment service providers, enabling them to base their decisions on factors such as their business model, customers’ preferences, costs, and settlement times. By breaking down the monopolistic control gatekeepers had over payment services, the DMA empowers developers with and enables businesses to have greater flexibility in managing their payment ecosystems.

There are quite a few alternative payment providers which we find worth taking a look at. They offer various functionality and differing plans for different business needs. Choosing the right payment processing platform can be quite challenging, though, as pricing and transaction fees differ significantly as do the features and inclusions.

If you’ve been looking for easier ways to receive customer payments online as an app or business owner, you’ve probably heard of Stripe many times already. Stripe is one of the most popular payment processing services out there, offering many merchant services as well as low and no-code options.

Stripe has many valuable features built into its system. The following ones are most useful to those willing to switch from the Google or Apple payment system:

Stripe charges on a pay-per-use basis for credit card processing. What does it mean? Usually users do not have a set monthly charge to pay. And it’s also possible to build a custom made Stripe package if that’s better for them. You can familiarize yourself with the list of applicable fees here.

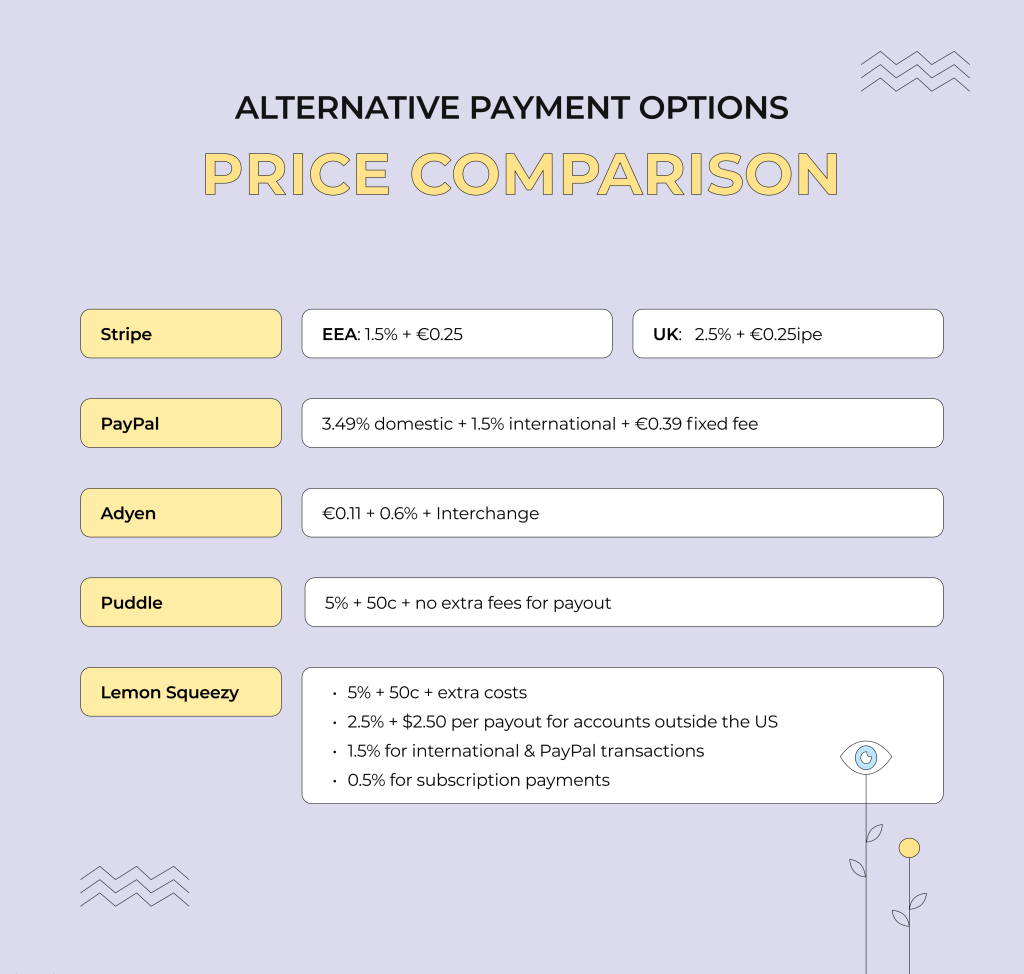

Stripe, similar to Google and Apple, also has transaction fees, although much smaller. Stripe charges 1.5% + €0.25 for each successful transaction in the EEA, and 2.5% + €0.25 in the UK. For online payment including Visa, Mastercard, American Express, Apple Pay, Google Pay and more the fee is 2.9% + €0.25 per successful card charge. Additional fees apply for specific scenarios: 0.5% for manually entered cards, 1% for international cards, and 1% if currency conversion is necessary.

Being one of the most popular global payment processors and having a huge community ready to help you solve any issues puts Stripe first on our list. It also supports many different platforms and is specifically tailored to address the needs of small businesses. Finally, Stripe Connect, an advanced payment platform-based business model, lets you easily handle transactions involving multiple parties. With it, you can split a single payment between numerous recipients, hold funds, or instantly pay vendors or service providers.

PayPal, a highly reputable payment processing company. In a way it has been a beacon of reliability in the industry for two decades. It stands tall among the most trustworthy and established processors, making it a popular choice for a wide range of products in the eCommerce sector. Moreover, PayPal’s support for various popular payment methods, including digital wallets and Apple Pay, further enhances its reliability.

Is it all sunshine and roses? What makes it slightly worse than Stripe, though? There are a few potential drawbacks to PayPal worth noting. There have been instances where funds have been unexpectedly frozen for various reasons. The most concerning scenario is when this happens due to a vague violation of the terms of service without any clear explanation.

Once PayPal decides to permanently restrict your account, there’s no going back. Even if they eventually agree to investigate your case, the reclamation process can be so lengthy that your app’s revenue stream could be severely impacted.

Is it the only problem PayPal has? Customer support is its weakest point. The theme of businesses being unsatisfied with PayPal customer support whenever any issues emerge has been ongoing for many years.

PayPal has the following fee structure: 3.49% domestic + 1.5% international + €0.39 fixed fee per transaction. QR code transactions have 2.29% + a fixed fee of €0.07. You will pay 2.29% + 0.09 USD when they go through a third-party integrator. You can check the complete list of fees here.

Adyen, a powerful international payment system and merchant account provider, is tailored to the complex needs of medium and large businesses. While it may be a little more expensive than its competitor, Stripe, its advanced features and capabilities justify the cost. Notably, eBay and Microsoft are among its esteemed clients, a testament to its reliability and effectiveness.

Is it a good choice for small businesses? Well, that’s a tough one. Sure, Adyen offers tremendous capabilities, but it will require substantial technical knowledge, time, and patience to make use of them. And the pricing could be better when smaller customers are concerned.

The Interchange+ fee becomes known only right before the transaction is processed, so comparing the pricing structure with other payment systems is quite challenging. The Adyen transaction is set at $0.13, but a payment method fee varies significantly across the board. Learn more here.

Do you do business internationally? Do you also need more accounting support? If the answer to these questions is yes, Paddle and Lemon Squeezy are the way to go. These two alternative payment providers bear the brunt of it all instead of you. They take care of the settlement of invoices and do your taxes internationally. So, if you lack an accounting department or have too many offshore customers, these two will be very helpful.

They support unconventional transaction types. Apart from sales, they can also work with discounts, coupons, and refunds. Sure, the fees are relatively high, but these costs would pay off quickly.

Paddle and Lemon Squeezy are Merchant of Record (MoR) platforms.

They declare themselves the legal entity selling goods or services to an end customer. This way, whenever there’s a new purchase, customers buy directly from them instead of from you.

In the end, it is these platforms that are ultimately responsible for handling all payments and everything relating to the purchase, including collecting sales tax, processing refunds, and chargebacks, and ensuring Payment Card Industry (PCI) compliance.

And it is their name that appears on the customer’s credit card or bank statement after each transaction.

Paddle is an alternative solution for payment processing and subscription management. Its primary focus is offering SaaS companies a brand-new approach to their payment infrastructure, helping them navigate the revenue process at every stage.

Paddle stands out with its robust fraud detection, offering a secure payment processing solution. It also boasts a rich set of features, surpassing Stripe. This platform is particularly well-suited for B2C companies, but it now caters to the needs of B2B companies with new features like automated invoicing. You can leverage its advanced features and APIs to streamline your B2B sales processes.

Paddle’s main problem is that its UI needs to be updated. For example, its checkout is not customizable enough.

Paddle is significantly cheaper than Lemon Squeezy. You can expect to pay 5% + 50c + no extra fees for payout per Checkout transaction. You can find more details here.

Lemon Squeezy is one of the newest entrants in the payment processing space. Its product is a simplified solution for small businesses and entrepreneurs, an all-in-one platform for running your SaaS business.

It can handle taxes with global tax compliance, payments, and subscriptions. It also has fraud prevention functionality, failed payment recovery, multi-currency support, PayPal integration, and much, much more.

With a much friendlier UI, Lemon Squeezy focuses on providing a straightforward user experience with minimal setup requirements, which is great for small businesses and app owners. Despite supporting basic payment methods, it may lack some of the advanced features offered by Stripe. Non-technical users may benefit a lot from Lemon Squeezy. Businesses with complex payment processing needs? Not so much.

It has a smaller ecosystem of integrations than Stripe. Given its relative newcomer status, its customer support team may also vary in availability and responsiveness.

Lemon Squeezy offers simpler pricing structures compared to Stripe, with fewer fees and transparent pricing plans. However, its pricing model may be less flexible or customizable compared to Stripe, especially for businesses with high transaction volumes or specific payment processing requirements. It’s important for businesses to carefully evaluate Lemon Squeezy’s pricing structure to ensure it aligns with their budget and needs.

Compared with Paddle, the base fee is the same, but this system collects more for other services. You’ll have to pay 2.5% + $2.50 per payout for bank accounts outside the US. For invoices and cashbacks, they will charge you the total transaction amount (5% + 50c) if you refund the customer. You can also expect to pay an additional fee of +1.5% for international (outside of the US) transactions, +1.5% for PayPal transactions, and +0.5% for subscription payments.

All in all, Stripe, as well as such Stripe alternatives as PayPal and Adyen mostly offer comparable functionality and services. Payment processing fees should be more or less the same, too. The most significant chunk of the fees goes straight to card issuers like Mastercard or Visa, so those payment processors only keep a small cut. Consider using these systems if you have a simple product, just one basic app, a limited amount of in-app purchases, an unsophisticated subscription model, etc.

Hi, I’m Marcin, COO of Applandeo

Hi, I’m Marcin, COO of Applandeo

Are you looking for a tech partner? Searching for a new job? Or do you simply have any feedback that you'd like to share with our team? Whatever brings you to us, we'll do our best to help you. Don't hesitate and drop us a message!

Drop a message