Top Trends Shaping the Future of Fintech

Trends shaping the future of fintech in 2022 range from better ways to optimize e-commerce platforms to revolutionize the global financial system. Here’s our list of the top trends to watch.

Trends shaping the future of fintech in 2022 range from better ways to optimize e-commerce platforms to revolutionize the global financial system. Here’s our list of the top trends to watch.

As we surge ahead into the 2020s, there are ever more ways to pay for the things we buy. Innovations in payments and while ecosystems around those payments continue to spring up and develop. Shoppers spent nearly $880 billion on e-commerce platforms in the U.S. in 2021, up 15% from 2020.

With these market shifts, retailers, tech companies, and consumers themselves are looking for new solutions to new challenges. Short-term credit, digital-only banks, immersive virtual reality shopping experiences, and even alternative currencies are just some of the current trends in financial technology.

Here are some of the latest fintech trends & innovations to watch in 2022.

Buy now pay later, or BNPL services have increasingly partnered with online retailers to offer shoppers more flexibility in their payment options. BNPL providers tout the benefits to both retailers and consumers.

Companies like Klarna, AfterPay, and Affirm charge retailers a commission on sales for increasing spending on their online platforms. Meanwhile, consumers have the flexibility to pay their purchases off in interest-free installments. As long as they pay on time, of course.

Shoppers who use a BNPL at checkout tend to be Gen-Z or millennials, and they also spend more than non-BNPL users. Offering alternative ways to buy leads to more purchases for larger amounts.

BNPLs differ from credit card purchases in several ways. Rather than having to pay off an item in full at the end of the month, you can spread it out across several months. For some, it offers a level of transparency. These services do come with some downfalls and risks, though.

Failing to pay a bill on time can incur hefty late fees. Some platforms charge a flat fee, others a percentage of the balance. Simply using BNPL services can also flag credit rating agencies and can affect consumers’ credit scores, especially ones that use them regularly.

Delinquency is much higher among BNPL users compared to standard credit card users. Whether that’s predatory lending practices or simply people who can’t handle their finances is up for debate. Regardless, BNPL providers are tapping into the booming e-commerce market and will continue to grow and adapt to market demand.

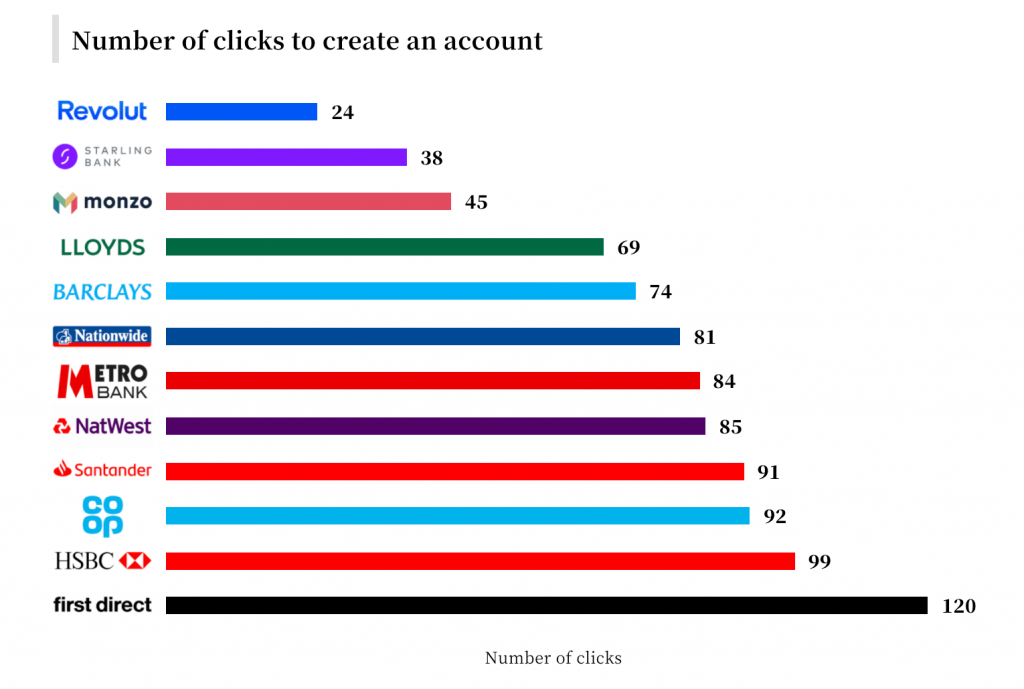

Who needs bank branches when you can have a banking app? Digital-only banks like Revolut and Wise offer their customers very competitive rates and more flexibility than traditional institutions. These banks don’t have any physical branches, and customers rely on an app to do all of their banking.

Foreign currency spending accounts and lower-cost international transfers are among the top benefits of these services. They’ve emerged to meet the demands of an increasingly global market.

One of the key ways digital banks can offer their customers such competitive rates is that they’ve pared down their own operations and have aggressively optimized their services. Much of that has to do with creating user-friendly applications that incorporate artificial intelligence.

AI can help fintech companies shore up profits by reducing overhead. Revolut, for example, uses AI to verify user identity in their initial know-your-customer procedure when you open an account. It’s also leveraging AI to detect fraud. Opening an account is fairly straightforward and can be done remotely.

However, these AI systems are far from perfect and can cause major headaches for real customers in the real world. Some actions can trigger the AI to shut down user accounts, and since many digital-only banks have bare-bones customer service teams, it can be a huge pain to solve common issues.

Better AI that helps these companies remain profitable and attractive and is one of the fintech trends digital-only banks can leverage to continue to grow and innovate. Hopefully, that development doesn’t come at the expense of decent customer service.

Asian markets such as China have had very successful super apps like WeChat and Alipay. These sprawling platforms combine integrated payment systems and an ecosystem of goods and services.

They also have a strong social element where people can build profiles, post statuses, and interact with each other. Part of the super app fintech trend is to increasingly develop their own payment systems. Facebook has been edging into this market as well.

Facebook’s parent company Meta plans to launch the Metaverse to compete with some existing super apps and also take it a step further by making it into an immersive virtual world. The Metaverse aims to be a one-stop place for users to interact, engage with content and also, of course, buy stuff. Plans are still in development and could take more than a decade to become fully functional. Nevertheless, Companies are already trying to capitalize on the platform.

One feature of the super app is the close integration of payments and social. Keeping users in one platform to do many of their daily tasks is part of what makes these initiatives so enticing. Some ideas for these ecosystems are to have their own native currencies. Facebook planned to launch its own cryptocurrency, Libra, though the company halted development in 2022.

Of course, giving one company so much power and influence over our lives is ominous for some observers. It’s still unclear how Meta and other platforms plan to protect user data, privacy and financial data, especially in light of the company’s numerous scandals to date. The trends are forging ahead and will continue to influence fintech, however.

Many of the fintech trends we’re seeing at the moment seek to optimize existing systems or to make purchases easier for consumers. Distributed ledger technology and the people experimenting with it want none of that. Blockchain technology and its promoters take aim at how our financial systems work and offer new models — for better or worse. While fully decentralized blockchains are currently unusable at scale, centralized systems that borrow aspects of DLT are emerging as possible innovations.

Blockchains distribute copies of data across a network of connected devices and update the records every time a new transaction occurs. They remove the need for a central authority to manage those records. They’re best suited to tracking on-chain digital assets such as cryptocurrency and preventing double-spending and counterfeiting.

Anyone can view the history of transactions on public blockchains like Bitcoin and Ethereum. DLT makes it nearly impossible to change data once it’s entered into the system. Think of it like a shared excel sheet no one can ever edit. Participants can only add new records.

Blockchain tech has been around as a concept for around 30 years, but the first applied use came over a decade ago with the Bitcoin blockchain. 10 years on, the technology remains experimental, but some cautiously promising features are being tested.

Cryptocurrency is the major use case, but very few people currently use cryptocurrency outside of fringe communities or places where local currency is more volatile. Current interest is primarily focused on betting on the speculative value of crypto assets. Initial coin offerings, non-fungible tokens, and other dubious investment vehicles have driven most of the demand. Virtually all of this commerce, unsurprisingly, happens in centralized exchanges that charge users hard fiat currency to participate.

The largest cryptocurrency by market capitalization, Bitcoin, averages fewer than 300,000 daily transactions. It has never broken 500,000 daily transactions in its history. The second-largest by market cap, Ethereum, completes a little more than a million daily transactions. By contrast, Visa processes 530 million daily transactions.

Like all great experiments, though, several features have spun off into areas that have nothing to do with crypto or with removing central authorities. Simply put, the core benefit of blockchain tech is that it makes it easier to audit data. Many central banks around the world are testing central bank digital currencies, or CBDCs, to move toward a more efficient, cashless society. By more efficient, of course, they mean easier to track and tax.

Representing fiat currency as a digital token has some benefits, especially in lowering the complexity and cost of cross-border payments. Many supporters also claim that it will increase financial inclusion in underdeveloped nations. Just how remains unclear.

Critics point out that issuing a CBDC could remove many of the tools central banks have in fighting inflation or responding to economic shocks. Their adoption could fundamentally change our financial system in unexpected ways.

Canada, the UK, Sweden, and as of March 2022, the U.S. have committed to conduct more research on CBDCs. Sweden is perhaps the farthest along with their e-Krona initiative that began in 2016. None are currently operational. These could impact the future of our financial system.

As these tech trends emerge and mature in the real world with real users, new challenges will come up. Part of what makes this industry so fascinating to watch is that many of the trends in fintech emerge and adapt or spin off new innovations that have little to do with the original idea. Just how the market will react to many of the payments innovations is still an open question. But if you throw enough solutions at a wall, some will surely stick.

For more tech trends and hot takes, follow our How We Innovate podcast on Spotify and check the episode with Kieron Cartledge, where we dive deep into the world of fintech 💸💡

Hi, I’m Marcin, COO of Applandeo

Hi, I’m Marcin, COO of Applandeo

Are you looking for a tech partner? Searching for a new job? Or do you simply have any feedback that you'd like to share with our team? Whatever brings you to us, we'll do our best to help you. Don't hesitate and drop us a message!

Drop a message