Fintech – Where Are We Post the Everything Bubble

Fintech may be the future of banking, but recent events have cast a shadow over its prospects. Or maybe brought new opportunities? Read our overview of this topic!

Fintech may be the future of banking, but recent events have cast a shadow over its prospects. Or maybe brought new opportunities? Read our overview of this topic!

2022 will be a year to forget for the once high-flying tech and fintech companies. In stark contrast to the exuberant market conditions in 2021, 2022 has been a slog of terrible headlines:

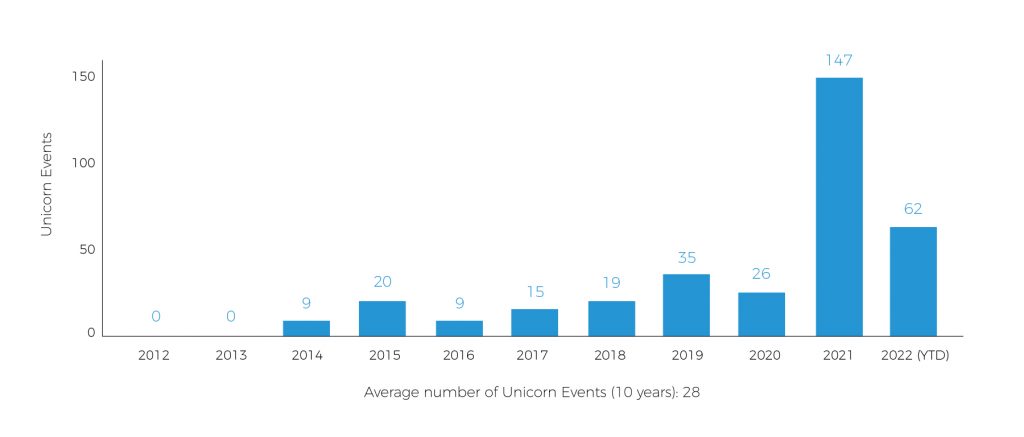

Unsurprisingly, Slack, social media, and the news are filled with a sense of panic. There is a sea of memes heralding an apocalypse in tech and horror stories of people looking for jobs on LinkedIn that are reminiscent of 2009. The once incredible innovators behind FANG and alike are now chastised for becoming “zombie companies” reliant on artificially low-interest rates to survive. The glory days of bumper new Unicorns (private companies worth over one billion USD) now seem like a distant memory as Unicorn events tanked throughout 2022 – see chart below. The “everything bubble” seemingly popped!

In times like these, it’s good to take a deep breath, look at the bigger picture and separate the signal from the noise. Despite the headlines, the long run opportunities across fintech and tech remain incredibly promising.

Fintech has become a loosely defined term that describes any company making technological advancements that have to do with money or financial assets; that covers: payments, eBanking, BNPL (buy now pay later), AI credit scoring, regtech, insurance, Real Estate, anything crypto related, etc… However, most of these things are just making the process of moving money or other financial assets easier, cheaper, and more effective through technology. That’s a good thing, and there is a lot of work to be done!

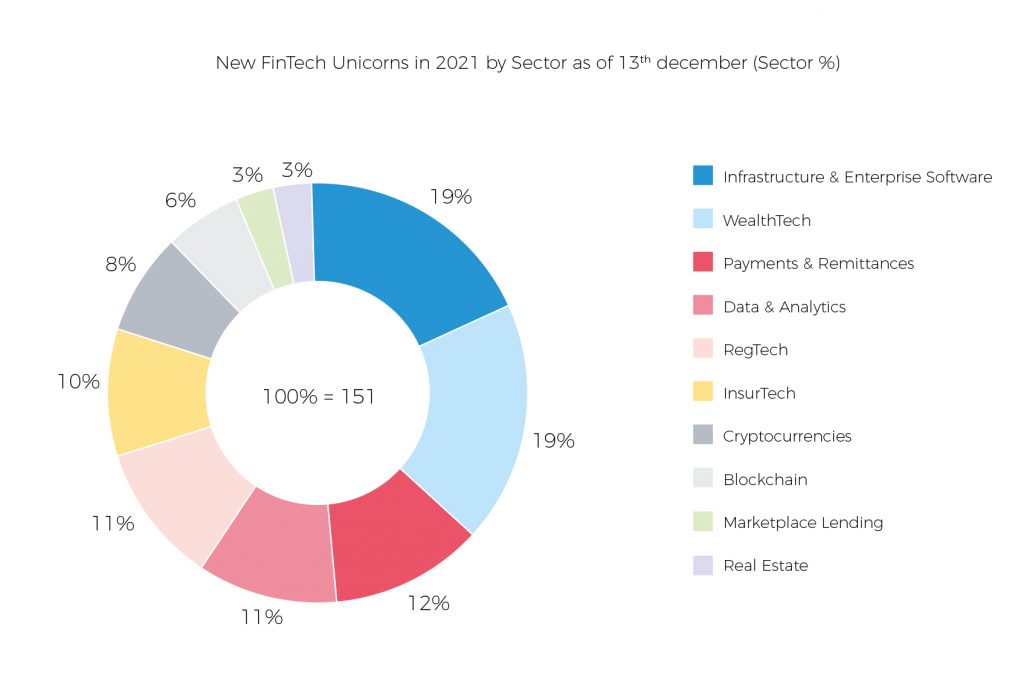

The fintech industry is particularly important as it represents approximately 1 of 5 Unicorns, the largest of any industry, according to CB Insights. Also, fintech is not just crypto; Despite crypto getting the lion’s share of media attention, it only represents about 8% of Unicorns as of Dec 2021 (see chart below).

Prior to tech, I worked across the finance industry. When I entered investment banking, I naively expected state-of-the-art technologies that I hadn’t seen before driving decision-making and data analysis. Instead, I found elegantly designed Excel spreadsheets which had largely remained the same over the last 20 years, processes that needed to be automated, and endless copy and pasting. I was all the more surprised to find that my colleagues across the largest and most well-funded financial institutions in the world had similar situations.

Despite what we see on TV, the financial world is typically conservative, highly regulated, and full of legacy processes and business relationships. Unsurprisingly, the rates of innovation are painstakingly slow relative to other industries. The slow-moving nature of tech in finance, coupled with relatively high labor costs, leaves a massive market gap for tech companies to innovate products and services that the large banks can’t do well. In the context of a rapidly evolving tech environment, it’s no wonder the financial services market is ripe with opportunities for disruption.

Furthermore, the broader landscape couldn’t be more against traditional financial institutions. The 2009 financial crisis created lingering angst against traditional financial institutions and an absence of customer loyalty. Central banks around the world have engaged in a decade of money printing, creating a lack of trust in fiat currencies and giving rise to the crypto market. These trends were accentuated by the 2020 pandemic, which saw government debt skyrock and requirements for e-versions of everything, including financial services.

2021 was a crazy year! The number of fintech unicorns surged almost 600% from the prior year (see chart below). Equity and crypto markets raged, and it was suddenly common for people in their 30s to be considering retirement in the upcoming years.

2021 was the perfect year for fintechs for a number of reasons. First, market sentiment globally was at full steam with the end of covid in sight and economic stimulative measures still largely in place leading to a boom in stocks. The US S&P 500 (the US Stock Market index) had over doubled in valuation from its pandemic lows in March of 2020. The rich valuation across markets made it easier for the number of fintech companies to reach a 1bn in valuation and startups to get more funding.

Second, 2021 was a huge year for cryptocurrencies. Bitcoin saw an absurd 16x increase in price from its intraday 2020 low of $3,867, reaching a now distant closing peak of over $64,000 in November of 2021. The increased valuation in crypto created rich valuations for the related fintech companies, providing an additional tailwind for fintech unicorns.

Third, a lot of the companies that were created in the 2010s with the cutting-edge technology of the time were reaching maturity and profitability. The average age of companies that became unicorns in 2021 was 6.4 years, which means many were created with cutting-edge technologies from 2010-2015, such as AI, big-data libraries and frameworks from Python, and ever more powerful coding technologies.

2021 was the perfect storm of maturing technologies, maturing companies, and perfect market conditions creating the high-water mark for fintech unicorns and the market at large.

Needless to say, 2022 has been a rude awakening for markets and the economy. In particular, increased interest rates and decreased equity valuations have made it much more difficult for startups to receive funding or reach unicorn status. The private market (where many fintech unicorns are valued) isn’t as directly visible, but it’s expected that it is down markedly on the year as equities drop. This means that many of the companies that became Unicorns in 2021 are likely not unicorns anymore.

However, even with the terrible market environment, the number of fintech unicorns in 2022 is more than double that of 2020 (see the chart above, “Number of Unicorn events in Fintech”), which is strong evidence that the fintech revolution is still intact. Moreover, the 2022 unicorn events will still be way above what they were prior to 2021 due to a relatively strong first half of the year, although Q3 and Q4 are looking rather bleak.

Just because global problems are evident and the solutions aren’t, doesn’t mean that things won’t get better or that the solutions will never come to fruition. Outside of the current dreary state of affairs, the rates of innovation in tech are and will likely remain astounding. AI will continue to open doors that we can’t imagine, De-Fi is just at its early stages and separating the wheat from the chaff, and more traditional coding technologies are rapidly creating ever-higher levels of abstraction and solving bigger problems.

Every day I’m reminded of the rapid pace of innovation as I’m surrounded by a company full of tech wizards at Applandeo who are constantly slaving away to make a more efficient and better world for us. When we step back from the immediate problems that plague the day, we are able to see the longer trends of remarkable continued progress, and it becomes evident that fintechs are just at the beginning. Although 2022 will likely be viewed as a year of problems and turmoil, the solutions around the corner are greater.

To the recognition of innovation and progress, and to the return of beer in the 2026 World Cup!

Hi, I’m Marcin, COO of Applandeo

Hi, I’m Marcin, COO of Applandeo

Are you looking for a tech partner? Searching for a new job? Or do you simply have any feedback that you'd like to share with our team? Whatever brings you to us, we'll do our best to help you. Don't hesitate and drop us a message!

Drop a message